Business Finance | Warren Buffett | Should We Depreciate Our People?

A Weekly Business Finance series for Non-Finance Executives!

“Financial Adrenaline” is a term we love around here because it reflects our commitment to help you turbocharge your business with practical tips and techniques to improve free cash flow, the lifeblood of business. As a further extension of our Financial Adrenaline program, we’re going to share a new Business Finance Tidbit every Wednesday specifically for those business executives who don’t have a finance background.

“Financial Adrenaline” is a term we love around here because it reflects our commitment to help you turbocharge your business with practical tips and techniques to improve free cash flow, the lifeblood of business. As a further extension of our Financial Adrenaline program, we’re going to share a new Business Finance Tidbit every Wednesday specifically for those business executives who don’t have a finance background.

____________________________________________

Depreciation = Cash? Why do we care?

We’ve kinda been on a Warren Buffett tear lately, and last week I encouraged you to read his recent 2010 Annual Report to Berkshire Hathaway shareholders.

I want to plant another seed this week about an often misunderstood concept: [kastooltip msg=”DEPRECIATION” tooltip=”In accounting, an expense recorded to allocate a tangible asset’s cost over its useful life. Because depreciation is a non-cash expense, it increases free cash flow while decreasing reported earning. It is used in accounting to try to match the expense of an asset to the income that the asset helps the company earn. For example, if a company buys a piece of equipment for $1 million and expects it to have a useful life of 10 years, it will be depreciated over 10 years. Every accounting year, the company will expense $100,000 (assuming straight-line depreciation), which will be matched with the money that the equipment helps to make each year.”]. (You can see the definition by placing your cursor over the term.)

I want to plant another seed this week about an often misunderstood concept: [kastooltip msg=”DEPRECIATION” tooltip=”In accounting, an expense recorded to allocate a tangible asset’s cost over its useful life. Because depreciation is a non-cash expense, it increases free cash flow while decreasing reported earning. It is used in accounting to try to match the expense of an asset to the income that the asset helps the company earn. For example, if a company buys a piece of equipment for $1 million and expects it to have a useful life of 10 years, it will be depreciated over 10 years. Every accounting year, the company will expense $100,000 (assuming straight-line depreciation), which will be matched with the money that the equipment helps to make each year.”]. (You can see the definition by placing your cursor over the term.)

How is Depreciation Relevant to EBITDA?

Today, let’s just think about it in terms of EBITDA. In Does EBITDA Bury Its Own Dead?, I wrote about the perils of treating EBITDA as a placeholder for cash flow, and Buffett couldn’t agree more.

In his Annual Letter to Shareholders, 2002, Buffet describes (more…)

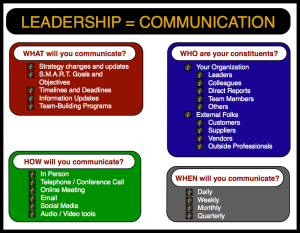

You need Leadership Skills to ascend to the C-Suite

You need Leadership Skills to ascend to the C-Suite