New here? Get more useful information by subscribing for free via email or our RSS feed. Let’s get started.

———————

Why is this so hard? We find ourselves entrenched in the quagmire of a lingering and painful recession … more companies than ever need stronger financial management … and yet so many of them remain painfully slow to recognize it. Sure, many have trimmed costs and are paying closer attention to nickels and dimes, but few of them have a comprehensive financial strategy.

Business Finance? Meet the Wine Industry!

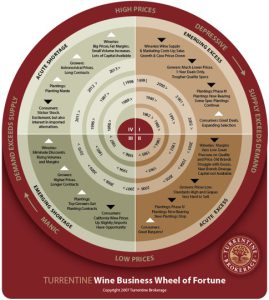

So, in some misguided way, I guess it feels good to have some company … because the need for financial discipline was a common refrain among wine industry cognoscenti at this year’s Symposium, Competing in a Rapidly Changing Global Wine Market. The economic shock waves of the last 24 months have rocked the wine industry, dragging many of its members, in some cases kicking and screaming … into an era where professional management and greater financial discipline are demanding front row seats alongside the entrepreneurs and artisans that have reigned over the California wine industry

[pullquote]Stronger financial management is overdue in the California wine industry.[/pullquote]

Building a bridge between the financial community and the wine industry is one of the founding precepts of the Wine Industry Financial Symposium formed in 1992. Last Monday, I was privileged to lead a 90 minute workshop devoted to Practical Strategies to Improve Cash Flow, in which I shared a few “diamonds in the rough” about how to get more juice into your bank account … and how the California wine businesses can integrate Strategic Finance into their everyday business decision making.

Wine, Wisdom and Stronger Finance. Drink up!

During the preceding From Survival to Prosperity – Strategies for Transition session, (more…)

Do you often wonder how this country gets along with the Pollyanna views inside the Beltway, mostly comprised of those who have never had to meet a payroll? The Senate passed the Small Business finance bill last week as a few Republicans crossed the aisle to provide the needed votes. The House is expected to quickly pass this version. More later … but ….

Do you often wonder how this country gets along with the Pollyanna views inside the Beltway, mostly comprised of those who have never had to meet a payroll? The Senate passed the Small Business finance bill last week as a few Republicans crossed the aisle to provide the needed votes. The House is expected to quickly pass this version. More later … but ….