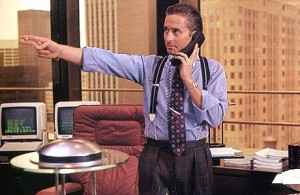

Leadership Styles: The Smartest Guys in the Room can kill you!

“When a fellow says it hain’t the money but the principle o’ the thing, it’s th’ money.” — Frank McKinney

‘Always ask why. Dig deeper. Get the facts.’ Avoid the crowd mentality

‘Always ask why. Dig deeper. Get the facts.’ Avoid the crowd mentality

“Ask Why” was their motto.

“Wheel Out,” “Fat Boy” “Death Star” and “Get Shorty” were some of the nicknames applied to their strategies.

Confirmation letters of successful trades were addressed to names like “Mr. M. Yass and “Mr. M. Smart” … and I think you can parse the underlying contempt.

“Rank & Yank” described their people performance system, “Pump and Dump” their trading strategy.

About $70 billion of market value was destroyed, more than 20,000 employees lost their jobs and pension funds worth $3.2 billion were destroyed, more than two thirds of which belonged to retirees with little chance to rebuild.

I had always intended to watch “The Smartest Guys in the Room,” the 2005 movie based on a book by the same name from co-authors Peter Elking and Bethany McLean, but it got lost in the shuffle until last week.

It chronicles the Enron cataclysm, whose meteoric ascent was violently terminated with its bankruptcy on Dec. 3, 2001.

“Be like Enron” is still an ignominious curse

It’s hard to believe this happened almost 10 years ago since to be “like Enron” still reverberates as an ignominious curse. It’s really more like a viral infection, though, because so many of the forces that drove its destruction have cleaved similar fissures in scandals from (more…)

Do you often wonder how this country gets along with the Pollyanna views inside the Beltway, mostly comprised of those who have never had to meet a payroll? The Senate passed the Small Business finance bill last week as a few Republicans crossed the aisle to provide the needed votes. The House is expected to quickly pass this version. More later … but ….

Do you often wonder how this country gets along with the Pollyanna views inside the Beltway, mostly comprised of those who have never had to meet a payroll? The Senate passed the Small Business finance bill last week as a few Republicans crossed the aisle to provide the needed votes. The House is expected to quickly pass this version. More later … but ….

I think that line is attributed to Ronald Reagan’s impressive debate performance against Jimmy Carter in 1980 … but just the same, it applies to the stream of recent articles about business lending in the middle market.

I think that line is attributed to Ronald Reagan’s impressive debate performance against Jimmy Carter in 1980 … but just the same, it applies to the stream of recent articles about business lending in the middle market.