A Weekly Business Finance series for Non-Finance Executives!

“Financial Adrenaline” is a term we love around here because it reflects our commitment to help you turbocharge your business with practical tips and techniques to improve free cash flow, the lifeblood of business. As a further extension of our Financial Adrenaline program, we’re going to share a new Business Finance Tip every Wednesday specifically for those business executives who don’t have a finance background. Our current Big River series started with We’re Making Money. Why are we broke? … then No Cash? Can we borrow what we need?, What if our loan collateral doesn’t cut it? and the need for outside investors.

“Financial Adrenaline” is a term we love around here because it reflects our commitment to help you turbocharge your business with practical tips and techniques to improve free cash flow, the lifeblood of business. As a further extension of our Financial Adrenaline program, we’re going to share a new Business Finance Tip every Wednesday specifically for those business executives who don’t have a finance background. Our current Big River series started with We’re Making Money. Why are we broke? … then No Cash? Can we borrow what we need?, What if our loan collateral doesn’t cut it? and the need for outside investors.

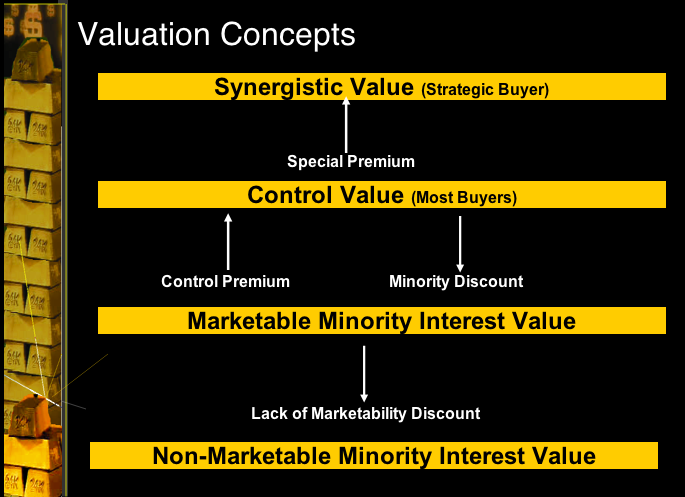

Last week, we began our conversation about business valuation. We continue that discussion today with a valuable chart that will help you understand some of the key valuation principles.

____________________________________________

“Can anybody remember when the times were not hard and money not scarce?”

~ Ralph Waldo Emerson

What’s the difference between a Strategic & Financial Buyer

John Wilson, CEO of Ace Business Stuff, has been working diligently with his controller, Tom Sampson, to assess his financing needs. They may require an equity investor as he suspects that his controller’s right that bank financing may be insufficient.

“Hi Lary,” John said when he got Lary Blogger on the phone again.

“We’re almost finished with our forecast, but it still looks like we’ll need some equity. I’d like to explore what you said about strategic buyers and financial buyers and see the diagram you mentioned.”

Different Buyers have Different Perspectives

“John, this diagram is only meant as a general overview of some key valuation concepts,” I said when I visited with John at his office a few days later. “It should help you better understand certain key concepts which underlie the valuation of an ownership interest in your company.

The Strategic Buyer will pay the highest premium

“At the top is the Strategic Buyer. In short, he’s looking for more than a simple financial return. He or she is looking to share a distribution network, like Google’s acquisition of YouTube, for example, or to expand an existing product line, like Mars buying Wrigley’s. These acquisitions are often about the “white space”, filling in gaps in the acquirer’s product line as we’ve seen happening in the wine industry, say with the sale several years ago of Rosenblum Cellars to Diageo. The expectation is that the Strategic Buyer will pay a “Special Premium” to obtain some of these strategic advantages.

The Financial Buyer has a different perspective

“Contrarily, the financial buyer is looking solely for a return on investment. That buyer is usually unwilling to pay a premium beyond his target rate of return. In the second horizontal bar, you’ll note the term “Control Value”. Keep in mind that when most people talk about “valuation”, they’re talking about value for the whole company, or at least a controlling interest of 51%.”

“But that’s not what I’m looking for,” John said. “I have no intention of selling my company. I’m just looking for a minority investor.”

What if you need a minority investor rather than a buyer?

“I understand, John, and that’s why I want to make sure you understand these concepts and how buyers and investors alike may look at your company. Since you’re considering a sale of a [kastooltip msg=”minority interest” tooltip=”A significant but non-controlling ownership of less than 50% of a company’s voting shares by either an investor or another company.”] in your company, the valuation is not the same as if you were selling a controlling interest.”

“I don’t see why not? They’re getting a piece of the same company I own and it should be worth to them what it’s worth to me.”

What kind of a discount is there for minority ownership?

“From a valuation perspective, John, it’s going to be worth more to you because you have a controlling interest. You’re the boss, you can elect a majority of your Board of Directors and you call the shots. Your potential partner has limited courses of action if he doesn’t like the direction in which the company is going.”

“Then he shouldn’t invest, Lary. It’s really that simple, isn’t it?”

“Absolutely, he must believe in the company as well as your leadership, but that doesn’t mean he has much influence over things if they don’t go well. So, let’s review the two primary discounts that occur from the valuation of a controlling interest in a company.

What is a Minority Discount?

“First, there is a [kastooltip msg=”control premium” tooltip=”An amount paid to gain enough ownership to set policies, direct operations, and make decisions for a business. Contrast with Minority Discount.”], or a [kastooltip msg=”minority discount” tooltip=”A reduction from the Market Value of an asset because the Minority Interest owner(s) cannot direct the business operations. Contrast with Control Premium.”] because, as I’ve said, the minority shareholders must depend on the majority shareholders to make wise decisions. Since they don’t control the company, their ownership piece is worth less, and therefore, they’ll expect to pay less to buy it.”

How is the Minority Discount applied?

“What you’re saying, Lary, is that if my company is worth, say $2 million, and I need to raise $400,000, I’m going to have to give up more than the 20% that I would get by multiplying $2 million by 20%. Is that right?”

“Generally speaking, that’s right, John. But in a negotiated situation like you’re thinking about, it might play out differently. If an investor agrees that the company is worth $2 million, he might conclude that it’s a fair proposition and pay $400K for a 20% interest.”

“What kind of discount are we talking about, Lary? How big is that so-called “minority discount?”

“I know you’ll love this answer, John … but it depends . . . on a number of factors that a qualified valuation specialist will assess. Why don’t we get into

those details another time?”

“Okay, but I don’t like the direction this is going, Lary. The value of the minority interest I’m selling keeps going lower.”

The value of a minority interest can get reduced even further

“I understand your point, John, but there is yet another, bigger factor to consider – a [kastooltip msg=”lack of marketability discount” tooltip=”A method used to help calculate the value of closely held and restricted shares. The theory is that a discount exists between the value of a company’s stock that is and is not marketable. Various methods have been used to quantify the discount that can be applied. The consensus of some studies suggests that this lack of marketability discount can range from 30-50%.”]. A minority investment in a private company is also an illiquid investment, and the lack of liquidity makes it less desirable, say, than a comparable investment in a public company. The minority investor in a private company is not usually able to ‘cash out’ until you do.”

“So, Lary, what are we up to, in total discounts I mean? Is there anything left for me?”

What do all these discounts amount to?

“First, John, these discounts don’t get added together. The ‘Marketable Minority Interest Value’ you see on the diagram gets calculated first by applying the minority discount. That term is roughly equivalent to share of stock of a publicly traded company; you’ve probably noted in your own experience that public company shareholders almost always receive a “control premium” when the entire company is purchased.

“At the same time, it’s quite different to own a share of publicly traded company that you can sell any time you’d like and a share in a privately help company where there is no ready market to sell it.”

What is the Lack of Marketability Discount?

“Sure, I guess so, Lary. That is an advantage with a public company, but I didn’t think about the fact that a share in our company isn’t very liquid. I can’t even sell my own shares back to the company with any expectation that they could afford to buy them from me.”

“That’s right, John. So lets look at how this “lack of marketability discount” works. It’s actually applied to the remaining net number, which is the “Marketable Minority Interest Value” to arrive at the Non-Marketable Minority Interest Value, which is at the bottom of the diagram. This generally represents the minority investment in a private company. All in? It wouldn’t be unusual for those discounts to equal a 30-45% discount from the value of a controlling interest in the same corporation.”

“So, in my little $2 million example, the value of my company to a minority investor might be more like $1.1 – $1.4 million or so. That’s a big difference.”

A Minority Investor has a unique perspective

“Yes it is, John. Remember, though, that in your case, this is a negotiated process and the potential investor won’t know all of this. I want you to be aware of these concepts, though, because minority investors are not easy to find for these two key reasons – they don’t have much control and they can’t get their money back easily.

“John, this is all the more reason you need to carefully prepare your forecast and be certain you’ve captured all of the unique attributes and capabilities of your company so you can justify a fulsome value and only raise the equity capital that you absolutely need.

“Let’s get together again next week when you have the forecast finished and we’ll talk further about this process.”